What should we do in the next 1–2 years for our buildings?

This checklist is designed for owners and portfolio managers who:

- May have received a “Notice of Required Action”

- Need a clear plan for the next 30 days, 60-90 days, and 12–24 months

In simple terms:

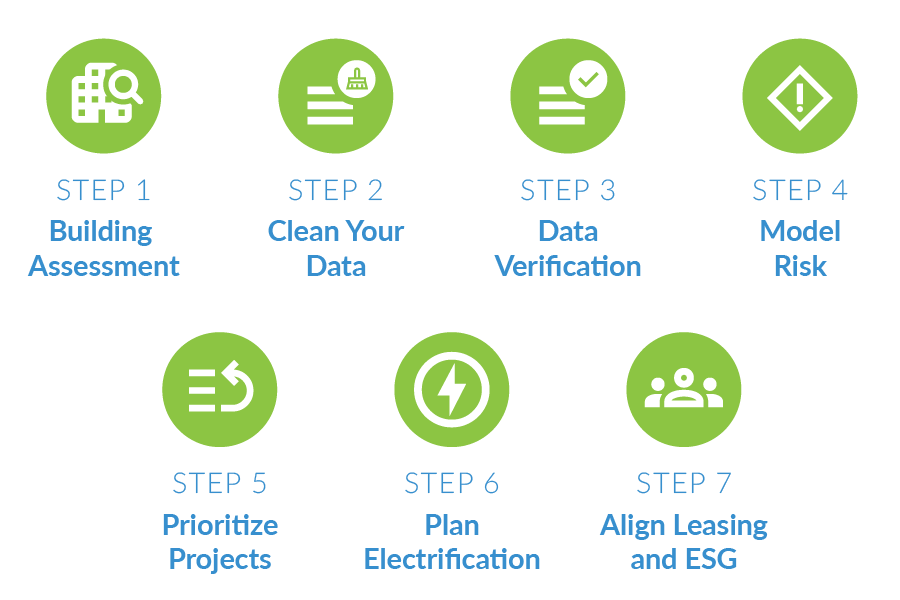

- Steps 1 to 4 focus on 60-90 days. Clean up data, confirm coverage, and understand your risk if you don’t take action.

- Steps 5 to 7 guide your five- to ten-year capital plan. They help you bundle BEPS work with planned upgrades instead of treating BEPS as a separate emergency project.

Together, these steps turn BEPS from a one-time compliance fire drill into a structured portfolio plan.

First 30 Days: Get out of Reactive Mode

Goal: Move from “We received a letter” to “We know which buildings are at risk and what data we can trust.”

In the first month, focus on four actions:

- Collect all BEPS notices in one place

- State letters, Montgomery County letters, and any emails from regulators.

- Build a simple building list

- Property name, address, gross floor area, primary use, jurisdiction (state only, Montgomery County only, or both).

- Log in to ENERGY STAR Portfolio Manager®

- Confirm that each covered building has an account and recent data.

- Book time with your internal team or advisor

- Schedule a working session to review coverage, notices, and data quality.

Once that foundation is in place, you can move into the seven steps below.

1. Map your coverage and status for each building

Create a one-page view of your entire portfolio.

- List jurisdiction, size, and primary uses.

- Flag any buildings that have received state or county notices.

- Flag any properties that might qualify for exemptions and confirm that applications are up to date.

This becomes your master reference for every conversation about BEPS.

2. Clean up your Portfolio Manager® account

Before you make decisions, you need reliable data.

- Confirm gross floor area against drawings or BOMA calculations.

- Correct space type breakdowns, especially for mixed-use properties.

- Make sure that all energy sources are included, with tenant meters and any backup fuel systems.

- Run data quality checks and correct any issues.

Clean, verified data is the basis for compliance, modeling, and incentives.

3. Plan data verification

Third-party verification is not optional, and it has its own timing.

- Plan data verification so you are ready for the first required deadline and the following three- or five-year cycles.

- Choose a data verification partner who knows both programs.

The goal is to treat verification as a scheduled task, not a last-minute scramble.

4. Model “do nothing” penalties

This is where BEPS risk becomes real for owners and lenders.

For each covered building with fossil fuel use:

- Estimate 2030 emissions from current data.

- Compare to the building’s emissions standard for its use type.

- Calculate excess metric tons of CO₂ and apply the state fee schedule through 2040.

For Montgomery County buildings:

- Compare the current EUI to the applicable EUI target.

- Estimate how many years a building might be out of compliance and apply county fine amounts.

This gives you a clear view of your risk if you take no action and helps you prioritize projects.

5. Identify “no regret” measures

“No regret” measures are projects that improve performance, reduce risk, and usually have reasonable paybacks. They are often the first projects in the capital plan.

Across the portfolio, build a list of measures that:

- Improve both EUI and emissions.

- Include straightforward implementation requirements.

- Support your long-term electrification plans.

These usually include:

- Controls upgrades and reprogramming

- VFDs on pumps and fans

- LED lighting and advanced lighting controls

- Smart thermostats for smaller or packaged systems

- Ventilation strategies that match occupancy patterns

Identify applicable incentive and funding programs. The goal is to use “stacked funding” where incentives, grants, and tax credits move projects into a three- to five-year payback range.

6. Plan for electrification and capacity

For buildings with major gas or oil systems, BEPS will eventually force a decision.

- Decide if you will replace them early with electric systems or accept ongoing penalties.

- Review the electric service capacity and the need for upgrades.

- Check the mechanical and roof space for future equipment.

A little planning now can prevent future surprises where an otherwise good project is delayed by service upgrades, space constraints, or structural limits you did not account for.

7. Align BEPS work with leasing and ESG

BEPS is not just an operations issue; it touches leasing, ESG, and investor relations.

- Work with leasing teams to make sure they understand the compliance plan for each building.

- Use BEPS progress and ENERGY STAR® improvements in sustainability, leasing, and investor communications.

- Create simple dashboards or heat maps that show:

- Which buildings are in good shape

- Which buildings need work

- Which projects are planned or in progress

Want help turning this checklist into a project plan for your portfolio?

Our team can help you:

- Clean up Portfolio Manager® data

- Model “do nothing” penalties

- Prioritize “no regret” projects and electrification steps

- Align BEPS work with capital plans and incentives