Table of Contents

- Maryland vs. Montgomery County BEPS: Overview

- Benchmarking, Energy Star Portfolio Manager®, and Data Verification

- Montgomery County BEPS Requirements

- Maryland Statewide BEPS Requirements

- How the Two Programs Work Together in Montgomery County

- Capital, Asset, and Transaction Risk

- What BEPS Means for Your Buildings

- 7 Step Maryland BEPS Plan

- Key Takeaways

- How Spectrum Supports Your BEPS Plan

Maryland BEPS compliance is no longer just a reporting requirement; it’s a factor in budgeting, planning, and how confidently you can manage your portfolio.

“Beginning in 2026 (and every 5 years after), benchmarking data must be third-party verified. Data cleanup needs to happen before compliance decisions are on the line.”

What is Maryland BEPS?

Maryland’s Building Energy Performance Standards (BEPS) require covered buildings to benchmark energy use annually and meet performance targets starting in 2030 or pay penalties.

In this guide you’ll learn:

- How to confirm whether your buildings are covered (state, county, or both)

- How to clean up and trust your Portfolio Manager® data

- How to build a prioritized action plan that aligns with ROI and capital timing

Start with 7 Practical Steps to Build a BEPS Plan

Understanding Maryland BEPS Compliance

Maryland has two overlapping BEPS programs:

- State of Maryland BEPS

Established under the Climate Solutions Now Act of 2022 and managed by the Maryland Department of the Environment (MDE). This statewide program focuses first on direct, on-site greenhouse gas emissions from buildings. - Montgomery County BEPS

A separate county program with its own thresholds, site EUI targets, and verification requirements. It applies to buildings in Montgomery County and sits on top of the state rules.

Mapping each building to the correct jurisdiction and program is the first step to avoiding missed reporting, penalties, and surprises at refinancing.

| BEPS Programs at a Glance | |

|---|---|

| Maryland State BEPS | Montgomery County BEPS |

| Measures: Direct on-site greenhouse gas emissions (tCO2e) | Measures: Site EUI (kBtu/sq ft/yr) |

| Covered buildings: 35,000+ sq ft | Covered buildings: 25,000+ sq ft |

| Primary metric: On-site GHG emissions | Primary metric: Site EUI target |

| Reports to: Maryland Dept. of the Environment | Reports to: Montgomery County DEP |

| Penalty: Fees for excess emissions | Penalty: Fines + transaction risk |

| What Owners Must Do: | What Owners Must Do: |

|

|

| In Montgomery County, both programs apply. Benchmark once, report to both. | |

Which properties are exempt from Maryland BEPS?

The statewide program includes several exemptions. However, exemptions are never automatic. Owners must apply and, in many cases, renew each year.

Common exemptions include:

- Registered historic buildings

- Public and nonpublic elementary and secondary schools (non-school buildings on the same parcel are not exempt)

- Manufacturing buildings

- Agricultural buildings

- Certain federally owned buildings

- Hospitals that apply and are approved

What do both programs measure?

Both BEPS programs focus on two core questions:

- How much energy does the building use per square foot?

- How much fossil fuel does it burn on site?

You answer those questions using:

- Gross floor area

- Use types and operating schedules

- Total energy consumption from all fuels, including:

- Electricity

- Natural gas

- Fuel oil or diesel

- Propane

- District steam or chilled water

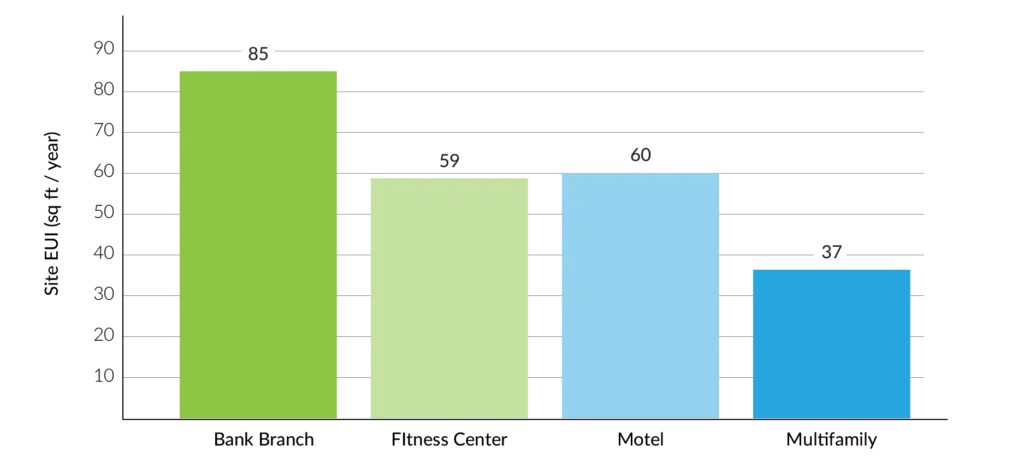

Typical Site Energy Use Intensity by Building Type

Why site EUI varies widely across commercial and multifamily buildings

Site EUI varies significantly by building type, which is why Montgomery County BEPS targets are use-specific rather than one-size-fits-all.

For mixed-use buildings, Montgomery County blends site EUI targets based on the share of each space type. Accurate space breakdowns and gross floor areas are critical.

Direct greenhouse gas emissions in the Maryland program

Maryland’s statewide program focuses on direct on-site greenhouse gas emissions from fuel combustion. These are often called direct emissions or Scope One emissions.

They include:

- Natural gas burned in boilers, water heaters, or process loads.

- Fuel oil or diesel for heating.

- Propane or any other fossil fuel burned on site.

Benchmarking and Data Verification: The Foundation of Compliance

Both BEPS programs rely on ENERGY STAR Portfolio Manager®. This is the central location where you model each building, track energy use, and generate the reports regulators will review.

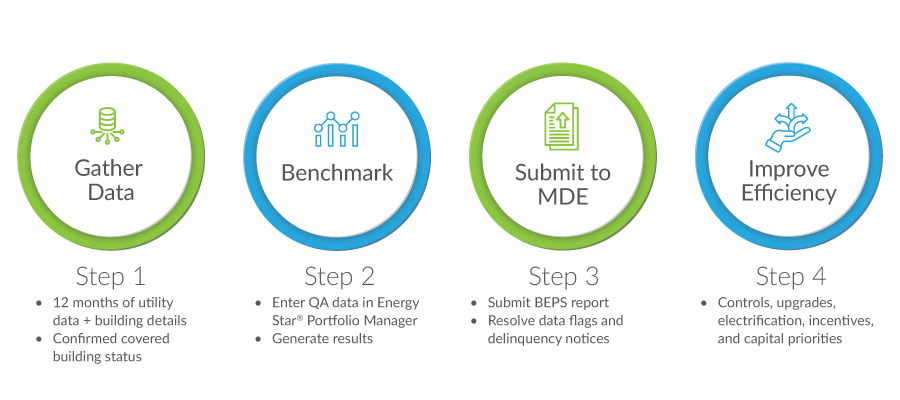

What benchmarking involves

- Create a profile for each covered building in Portfolio Manager®.

- Enter the address and gross floor area.

- Identify the property type and any space type breakdowns, such as retail on the first floor and office on upper floors.

- Upload twelve consecutive months of utility data for each fuel type.

- Make sure all usage is captured.

- Base building systems

- Tenant spaces and common areas

- Submit building data through:

- The state BEPS reporting portal for Maryland

- The Montgomery County BEPS reporting portal, if applicable

Primary sources (official program pages)

Use these pages for deadlines, portals, covered-building lists, and verification requirements:- Maryland BEPS overview + official guidance (MDE)

- Maryland BEPS: Get started + Portal instructions (MDE)

- Maryland BEPS Portal (find building / UBID / dashboards / forms)

- Maryland Benchmarking Guide (PDF manual)

- Montgomery County BEPS program page (DEP)

- Montgomery County energy benchmarking requirements + how to report

- Montgomery County Benchmarking Reporting Portal (claim buildings, submit reports)

- Montgomery County data verification requirements + how-to guidance

- Plan improvements.

- Update controls, consider electrification, and mechanical upgrades

- Explore incentives

- Prioritize capital investments

Many BEPS projects qualify for multiple incentives and funding sources. When coordinated correctly, these programs can significantly offset and in some cases exceed upfront project costs.

This example project combined utility rebates, state grants, federal tax benefits, and county support to more than offset upfront capital costs.

Incentives and tax benefits vary by building type, eligibility, timing, and location. This example illustrates how multiple funding sources can be stacked and is not always a guaranteed outcome.

Real world example:

A 13-story mixed-use office building used early BEPS benchmarking to identify phased upgrades, reducing energy use by 22% and avoiding last-minute compliance decisions.

Read the full case study →

Utility companies can help by sending aggregated whole-building data, especially when you have many separately metered tenant spaces. Verify that the coverage, dates, and meters are correct.

Data verification cycles

In addition to annual benchmarking and reporting, both programs require independent third-party data verification. That means a qualified professional who is not part of your day-to-day building staff must review your benchmarking data and confirm that:

- The building information (square footage, use types, operating hours) is accurate

- The utility data is complete and matches actual bills or metering

- The calculations in Portfolio Manager® are correct and consistent with program rules

This verification is usually documented with a signed form or report and submitted through the BEPS reporting portal on a set schedule.

The goal is to give the state/county confidence that decisions about compliance and penalties are based on reliable, verified data rather than estimates or incomplete records.

Who can verify your data?

- An engineering or energy consulting firm, like Spectrum Energy.

- A licensed design professional

- A qualified energy professional working outside your internal operations team

Timing:

- Maryland State (outside Montgomery County)

- First verification required by June 1, 2026

- Repeat verification every five years

- Montgomery County

- Requires verification in the first year that a building reports

- Requires verification again every three years

Between verification dates, it is still the owner’s responsibility to maintain accurate, current data and correct issues as they appear.

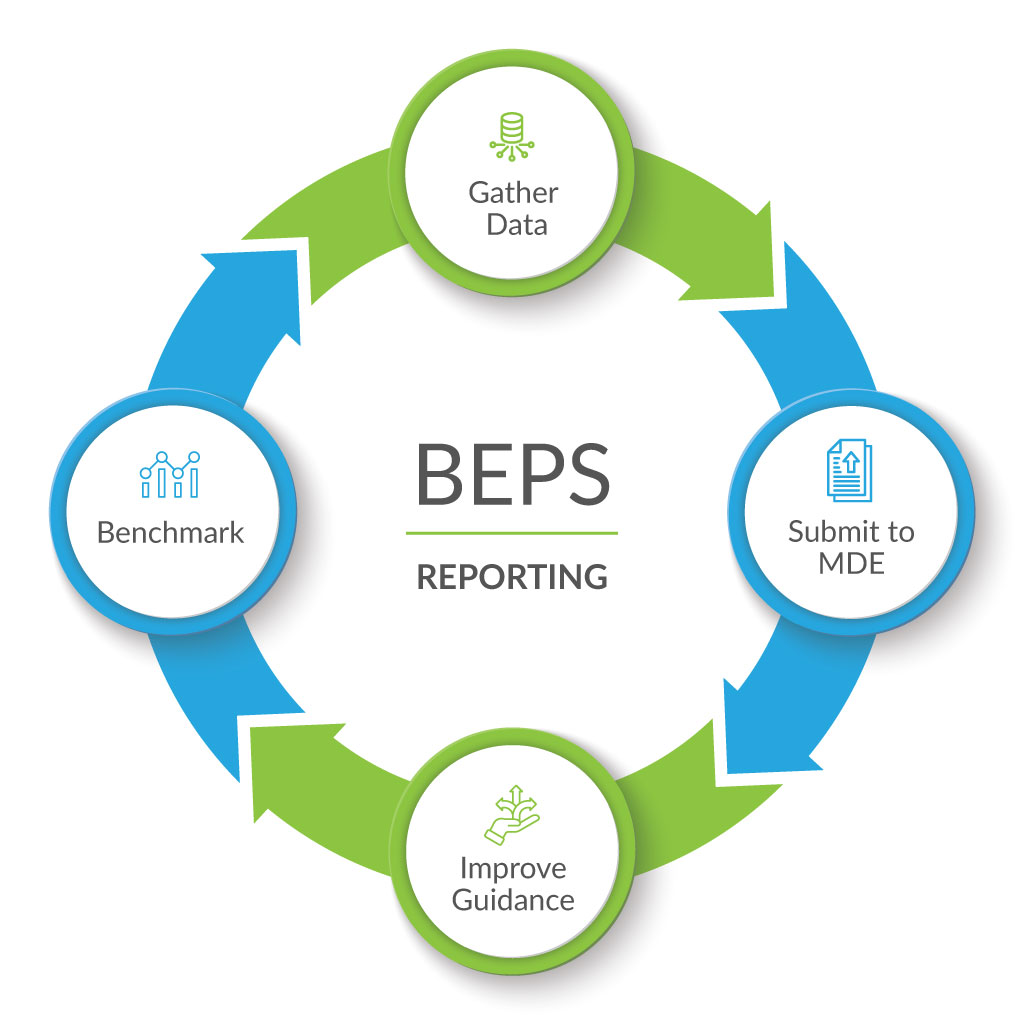

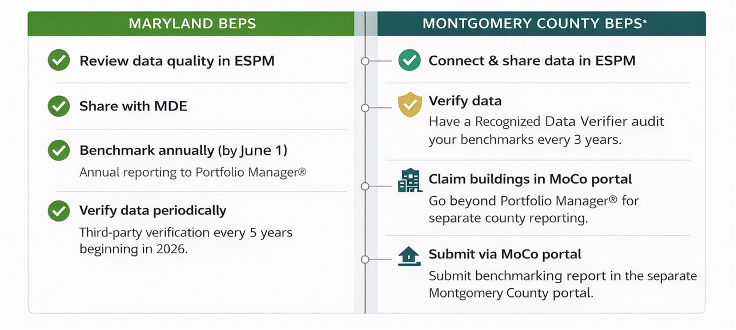

Maryland and the Montgomery County BEPS Processes

*For buildings located in Montgomery County: All steps in both columns apply. Benchmark once in ENERGY STAR Portfolio Manager® (ESPM), share with MDE and Montgomery DEP, follow both verification schedules, and submit annual reports through the Montgomery County Benchmarking Reporting Portal.

Maryland Statewide BEPS Requirements

Maryland State BEPS applies to most commercial and multifamily buildings 35,000 square feet and larger.

Key points:

- Coverage is based on the total gross floor area of the building, not just leasable space.

- Certain building types may qualify for exemptions, but those exemptions must be requested and renewed.

- If a building is in Montgomery County, it is still part of the statewide BEPS program, even though it is also subject to county rules.

Owners should confirm whether each property is on the state’s covered building lists and check that the size, address, and use types are correct.

Maryland key performance metrics

The Maryland program measures:

- Direct on-site greenhouse gas emissions in metric tons of CO₂e per year

- Future energy performance standards, which will be informed by site EUI after enough data has been collected

Each covered building’s baseline is calculated from its own historical energy use, typically using the two highest consumption years within a three-year window. For buildings with the same use type, the final performance standard is the same. Some buildings are already close to that target, while others are much further away.

Poor-performing buildings must improve more than efficient ones to meet the standard.

Maryland benchmarking and verification

For covered buildings, annual benchmarking is the foundation of compliance.

Key points for the state program:

- Benchmarking uses calendar year data, starting with 2024.

- Covered buildings must report through ENERGY STAR Portfolio Manager® to the state BEPS portal.

- The first data verification is required June 1, 2026, and must be repeated every five years after that.

Between verification years, owners are responsible for keeping data accurate, running quality checks, and correcting any flagged issues.

This benchmarking and verification work supports all later performance standards and penalty calculations.

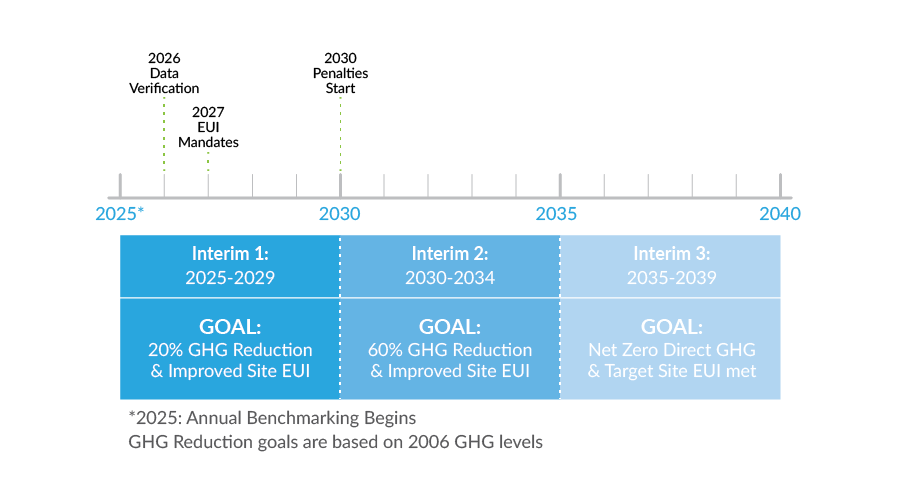

Maryland BEPS timelines, targets, and penalties

Once benchmarking and verification are in place, the next concern is when standards take effect and what happens if a building falls short.

Maryland BEPS Timeline and Standards

Maryland’s 3-phase program

Maryland BEPS final target standards

Looking at the chart below, from 2030–2034, buildings must meet or stay below the greenhouse gas emission limits shown in metric tons of CO₂e. In each following period, the standard tightens, cutting the allowable emissions for each building type until the requirement reaches net zero in 2040.

| Property Type | Net Direct Emission Standards 2030 – 2034 (kg CO2e/sqft) |

Net Direct Emission Standards 2035 – 2039 (kg CO2e/sqft) |

Net Direct Emission Standards 2040 (kg CO2e/sqft) |

Final Site EUI Standard 2040 (kBtu/sqft) |

|---|---|---|---|---|

| College/University | 2.43 | 1.21 | 0 | TBD |

| Fitness Center | 2.87 | 1.43 | 0 | TBD |

| Hotel | 1.47 | 0.74 | 0 | TBD |

| Multifamily | 0.82 | 0.41 | 0 | TBD |

| Museum | 0.75 | 0.38 | 0 | TBD |

| Office | 0.22 | 0.11 | 0 | TBD |

| Office – Medical | 0.18 | 0.09 | 0 | TBD |

| Residence Hall/Dormitory | 0.70 | 0.35 | 0 | TBD |

| Retail Store | 0.60 | 0.30 | 0 | TBD |

| Strip Mall | 1.90 | 0.95 | 0 | TBD |

| Worship Facility | 0.87 | 0.44 | 0 | TBD |

Note: Mixed-use buildings have an area-weighted standard based on the percentage of gross floor area assigned to each property type.

(To convert kilograms to metric tons: divide by 1,000.)

Maryland alternative compliance penalty

Starting in 2030, buildings will face an annual penalty of $230 for each metric ton of excess CO₂e. Beginning in 2031, this penalty increases by $4 each year.

| Year | Penalty $ per metric ton of excess CO2e |

|---|---|

| 2030 | $230 |

| 2031 | $234 |

| 2032 | $238 |

| 2033 | $242 |

| 2034 | $246 |

| 2035 | $250 |

| 2036 | $254 |

| 2037 | $258 |

| 2038 | $262 |

| 2039 | $266 |

| 2040 | $270 |

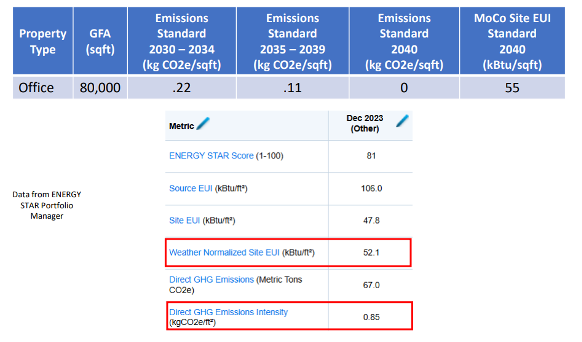

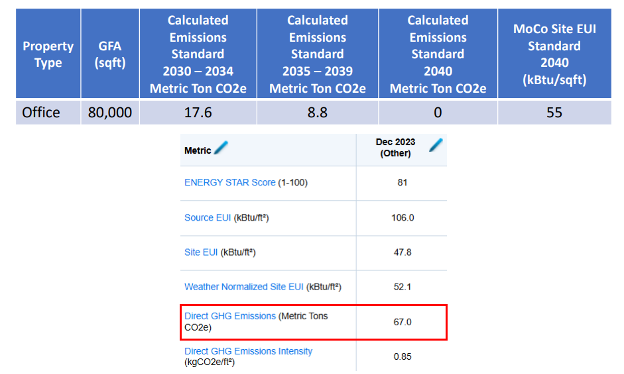

Maryland Example: Office building with natural gas heat

For an 80,000 sq ft office, the 2030–2034 standard is 0.22 metric tons of CO₂e per sq. ft. Today, it operates at 0.85 metric tons per sq. ft.

Assumptions:

- Metric basis: kg CO₂e per sq ft (kg CO₂e/sf)

- Building size: 80,000 sq ft office

- Fuel type: Natural gas heat (Scope 1 / on-site emissions)

- Penalty rate shown: $230 per metric ton (tCO₂e) in 2030

That translates to 17.6 metric tons allowed versus 67 metric tons actual, or 49.4 metric tons over the limit. (To convert kilograms to metric tons: divide by 1,000.)

At $230 per ton in 2030, that year’s building penalty is $11,362. As the per-ton rate rises and the standard tightens in 2035, the yearly penalties grow. As the penalty example above shows, one 80,000 sq ft office can face more than $11,000 per year in fees, with cumulative six-figure penalties if no action is taken.

| Total Penalty from 2030 to 2040 | ||

| Year | Metric tons CO2e above Standard | Penalty $ per metric ton of excess CO2e |

|---|---|---|

| 2030 | 49.4 | $11,362 |

| 2031 | 49.4 | $11,560 |

| 2032 | 49.4 | $11,757 |

| 2033 | 49.4 | $11,955 |

| 2034 | 49.4 | $12,152 |

| 2035 | 58.2 | $14,800 |

| 2036 | 58.2 | $15,037 |

| 2037 | 58.2 | $15,274 |

| 2038 | 58.2 | $15,510 |

| 2039 | 58.2 | $15,747 |

| 2040 | 67.0 | $18,090 |

| $153,244 (Present value of $80,727 assuming six percent interest) | ||

This example reflects the Maryland state program and applies only to greenhouse gas emissions. Once EUI standards are in place, the state may also introduce penalties tied to EUI performance and compliance.

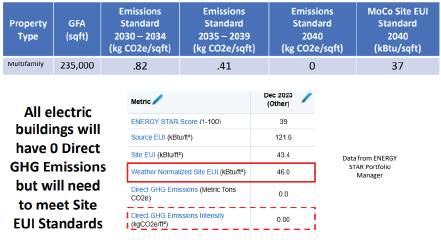

Maryland Example: Multifamily all-electric building

In this example, the 235,000 sq ft building has zero greenhouse gas emissions; therefore, it is compliant with Maryland State BEPS.

Assumptions:

- Building type/size: 235,000 sq ft multifamily building

- Fuel type: No on-site fossil fuels (zero direct emissions)

- Important nuance: This may be compliant under the Maryland state emissions metric, but could still be out of compliance under Montgomery County site EUI targets if performance is poor.

- Future risk: If Maryland adds EUI-based standards later, status could change.

Buildings that do not use natural gas, propane, or fuel oil are compliant based on the current standards. When EUI requirements are set, buildings may change from compliant to non-compliant.

Montgomery County BEPS

Montgomery County has its own BEPS law. These local rules do not replace the statewide program; they are in addition to it.

What is the difference?

Key differences from the state program, beyond the building size starting at 25,000 sq ft:

- The primary metric is site EUI (kBtu per sq ft per year), not direct emissions.

- Each building type has a final site EUI target that it must meet or beat by the end of the compliance period.

- Mixed-use buildings are assigned a blended target based on the proportion of each use type.

Montgomery County publishes covered building lists and assigns buildings to compliance groups. Owners should confirm:

- That each building is listed correctly

- Gross floor area and primary use types

- Which compliance group and deadlines apply

The table below shows the maximum site EUI each building’s ‘use type’ must meet at the end of the BEPS period.

More energy-intensive uses, such as bank branches, medical offices, and strip malls, are allowed higher targets. Less intensive uses, such as museums, multifamily housing, and worship facilities, have lower targets.

| Property Type | MoCo Target Site EUI (kBtu/sqft) |

|---|---|

| Bank Branch | 85 |

| Fitness Center | 59 |

| Hotel | 60 |

| Multifamily | 37 |

| Museum | 29 |

| Office | 55 |

| Office – Medical | 70 |

| Residence Hall/Dormitory | 38 |

| Retail Store | 48 |

| Strip Mall | 58 |

| Worship Facility | 32 |

Compare your building’s current site EUI in Portfolio Manager® to the target for its primary property type in this chart. The gap between those two numbers is the improvement you will need by the final compliance date.

For mixed-use properties, Montgomery County calculates an area-weighted target based on the percentage of floor area assigned to each property type. Each portion of the building aligns with the standards for its use.

Benchmarking and verification in Montgomery County

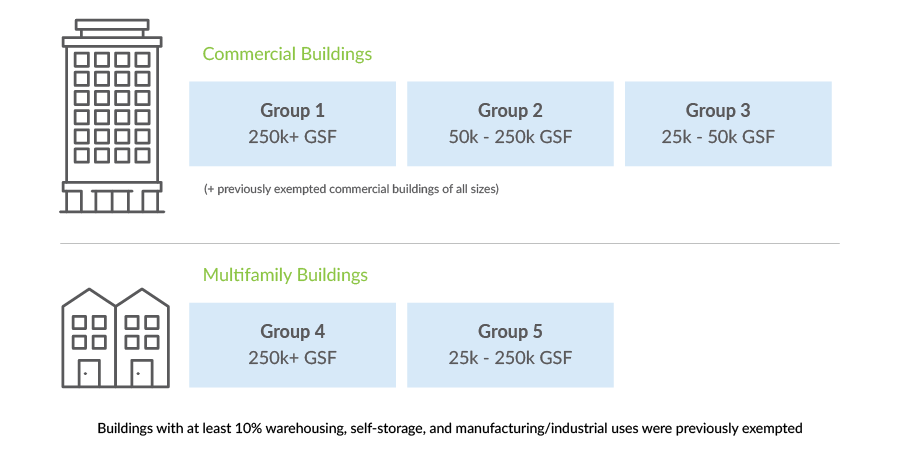

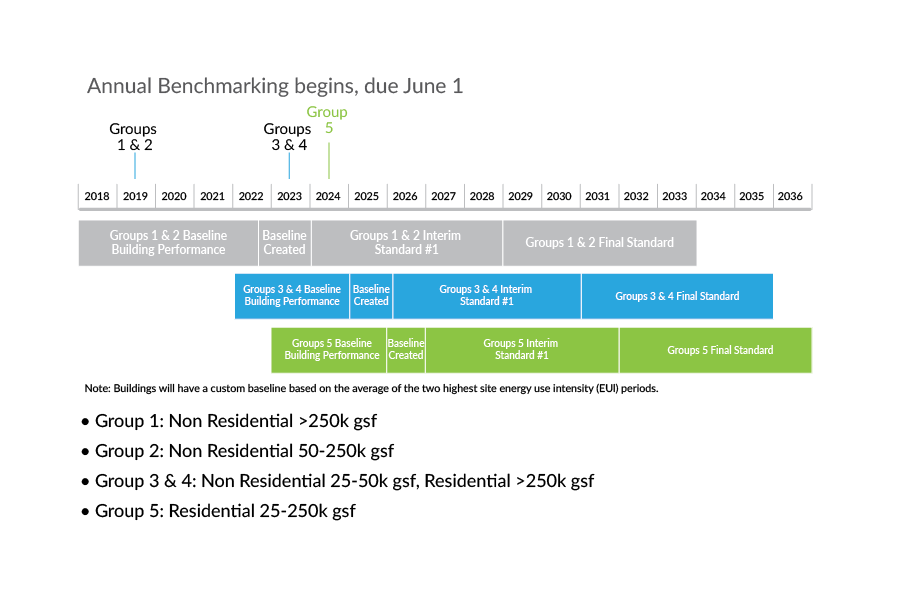

Montgomery County uses a phased approach to benchmarking and BEPS compliance. The graphic shows how covered buildings are sorted into five groups based on size and primary use:

Buildings Covered by Law in Montgomery County

Step 1: Confirm you’re on the covered building list.

Step 2: Find your group.

Step 3: Put deadlines on a 1-page calendar.

Knowing each building’s group helps you line up benchmarking, verification, and performance targets on one internal calendar instead of treating every property as a one-off.

Montgomery County compliance requires:

- Annual benchmarking using ENERGY STAR Portfolio Manager®

- Third-party data verification in the first year a building reports and every three years after

- Meeting the assigned site EUI targets or demonstrating required performance improvement to avoid penalties

Montgomery County penalties

Each covered building is compared to an area-weighted EUI target for its mix of property types.

If a building does not meet the benchmarking or EUI requirements, the county may levy civil fines of:

- Up to $500 for a first violation

- Up to $750 per year for repeat violations

While these dollar amounts are modest compared to potential capital projects, repeated noncompliance can become a due diligence issue in sales, refinancing, and legal reviews. A record of penalties or poor BEPS performance may be a red flag for buyers, lenders, or investors.

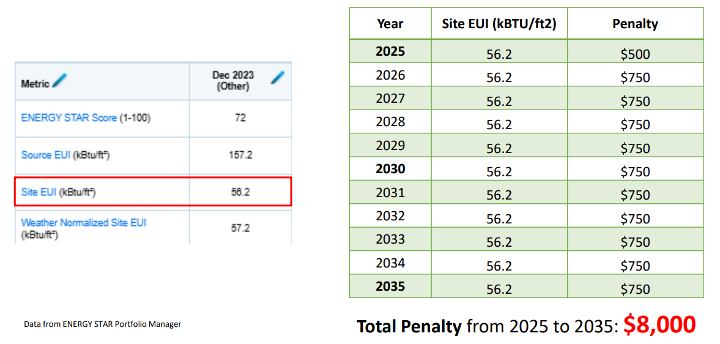

Montgomery County Example: Office with natural gas heat

In the example below, a building that is out of compliance incurs relatively modest annual penalties totaling $8,000 from 2025–2035. On paper, that may not look significant, but BEPS noncompliance can create issues far beyond the fee itself.

When you sell or refinance, unresolved compliance problems can raise questions about the building’s standing with the state, delay closing, or put downward pressure on the sale price. It is much better to address BEPS requirements upfront than have them surface at the end of a major transaction.

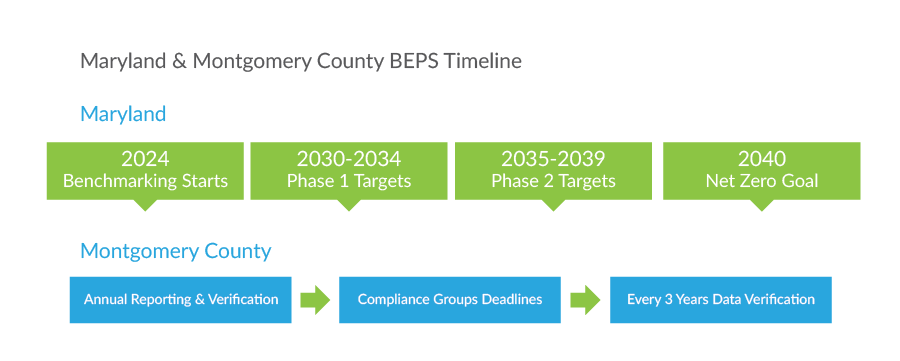

How State and County Programs Work Together in Montgomery County

This timeline shows how Maryland State and Montgomery County BEPS requirements overlap, so owners can plan projects once, instead of reacting twice.

BEPS compliance is not a single pass or fail test.

The same benchmarking data is evaluated under two different rulesets, which means a building can pass one program and still fail the other.

It is helpful to build a simple portfolio matrix that shows, for each building in Montgomery County:

- State BEPS status today (compliant, at risk, or above emissions standard)

- Montgomery County BEPS status today (below target, near target, or above site EUI target)

- Planned projects that move both metrics in the right direction

Capital, Asset, and Transaction risk

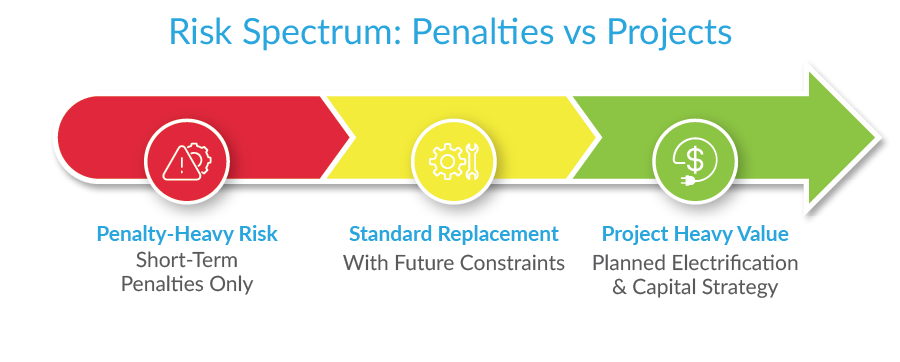

For most portfolios, the right move is to fold BEPS-driven upgrades into existing five- and ten-year capital plans and major tenant improvement cycles, not to launch a separate BEPS project. That’s where early benchmarking and modeling really pay off.

Standard investments

Installing new natural gas or other fossil fuel equipment today can create a problem later. For example, the useful life of a boiler is often longer than the time remaining before 2040. To meet the net-zero direct emissions deadline, you may have to retire equipment early, upgrade electrical service, and rework mechanical and electrical spaces.

The biggest surprise for owners is that standard replacements, like new gas boilers, can lock them into early retirement and extra electrical upgrades later.

Penalty risk

Choosing not to invest, or waiting too long, brings a steady stream of penalties. For certain buildings, “do nothing” can cost as much as a significant capital project over a decade.

Chart showing how some owners choose to do very little and treat BEPS as a series of fees. They pay short-term penalties instead of making upgrades, which keeps capital costs low now but builds long-term risk and does nothing for asset value.

- Transaction risk

A non-compliant BEPS status can raise flags for buyers, lenders, and investors. It can slow closings, reduce offers, or force last-minute escrow negotiations.

- Tenant and Leasing Considerations

Under current Maryland rules, owners are responsible for BEPS penalties. There is no direct mechanism to send those charges to tenants. If a tenant-driven load, such as a lab or data room, pushes a building over its target, the owner still receives the bill unless leases are written carefully enough and the law allows cost recovery.

- Disruption and communication

Controls, lighting, and mechanical systems upgrades can be planned around tenants, but only with coordination and clear expectations. This is important to consider for sensitive occupancies, such as medical, research, or technology suites.

What BEPS Means for Your Buildings

BEPS changes how capital planning, leasing, and ESG reporting fit together.

| Opportunities | Risks (if unmanaged) |

|---|---|

| BEPS-aligned projects can support ESG and decarbonization goals | Capital investment is required, even when incentives help |

| Performance improvements can strengthen leasing narratives and certifications | Missed targets can lead to ongoing penalties |

| Upgrading inefficient systems can improve asset value and tenant comfort | Benchmarking, modeling, and compliance require time and expertise |

| Lower energy use can stabilize operating costs over time | Poorly sequenced projects can disrupt tenants or delay transactions |

Spectrum POV: The difference between BEPS as an opportunity or a burden is planning—early, portfolio-level planning turns risk into control.

This shift from reacting to compliance to planning is easier to understand with a real example.

7 Step Maryland BEPS Plan

For many owners, BEPS becomes real when a “Notice of Required Action” arrives for one or more buildings. The goal is to move quickly from “We received a letter” to “We have a clear, defensible plan we can share with ownership and lenders.”

In simple terms:

- Steps 1 to 4 focus on the next 60 to 90 days.

- Steps 5 to 7 shape your five to ten-year capital plan, so BEPS work is sequenced with other upgrades instead of being treated as a last-minute emergency.

Use these seven steps as a high-level roadmap.

- List covered buildings and jurisdictions

- Clean up benchmarking data

- Plan for data verification

- Estimate “do nothing” penalties

- Identify “no regret” projects

- Plan for major system and electrification decisions

- Align BEPS planning with leasing and ESG

Want a more detailed checklist of this plan? 7 Steps to Get Maryland BEPS-Ready

Key Takeaways

- Annual benchmarking and data verification are required, and penalties start in 2030 at the state level.

- Coverage and exemptions depend on building size, location, and use type. Exemptions must be applied for and renewed. They are never automatic.

- Accurate benchmarking data in ENERGY STAR Portfolio Manager® is the foundation of every decision. If the floor area, use types, or energy data are wrong, your compliance strategy will be off.

- State-level penalties for direct emissions can easily reach six figures for some buildings if no action is taken. County fines are smaller in dollars, but noncompliance still creates legal and transactional risk.

- Targeted projects that improve controls, lighting, and distribution can reduce energy use, improve comfort, support compliance, and, with the right incentives, often pay for themselves.

- The strongest position is to fold BEPS into your five- and ten-year capital plans now, instead of treating it as a surprise emergency just before deadlines.

In Maryland, many of these ‘no regret’ measures qualify for utility incentives, state programs, and federal tax credits. For some buildings, stacked incentives can cover a significant share of project costs, improve ROI, and ease budget pressure.

How Spectrum Supports Your BEPS Plan

For most portfolios, the challenge is turning BEPS requirements and benchmarking data into plans you can act on. Spectrum Energy helps you:

- Determine which buildings report to the state, which report to Montgomery County, or both

- Clean up Portfolio Manager® data so it is reliable

- Compare the cost of doing nothing to a set of realistic project pathways over the next several years.

We identify no regret measures, plan electrification, and align projects with incentives and capital plans. You know which buildings to prioritize, what it will cost, and how each step supports compliance and long-term value.

Get started with your BEPS compliance plan

Frequently Asked Questions

Q. I have a campus with multiple buildings. Do I enter all buildings separately in Portfolio Manager®?

A. BEPS regulations include a campus compliance option. This allows multiple buildings on a campus to be treated as a single entity for compliance, as long as the campus as a whole meets the performance standards.

Q. Can renewable energy be used to reduce my building’s GHG emissions or EUI?

A. GHG: Renewable energy does not reduce your reported GHG emissions. BEPS rules focus on direct, on-site fuel use, while renewable electricity is treated as an indirect emission.

A. EUI:

Montgomery County: Yes. Qualifying renewables are reflected in the Net site EUI.

Maryland State: To be determined. The state will resubmit EUI standards in 2027. The current intent is to align with Montgomery County’s approach.

Q. Does BEPS mean I have to replace my gas or oil heating systems right away?

A. Not automatically. BEPS sets performance targets, not specific equipment mandates. Many buildings can make progress with lower-cost measures first, such as controls, ventilation strategies, and efficiency upgrades, while planning for larger electrification projects over time. However, if a building cannot meet performance standards with efficiency measures alone, you may eventually need to replace systems or accept ongoing penalties as part of your long-term capital plan.

About the Author

Chet Knaup, PE, BEMP, LEED AP BD+C

President, Spectrum Energy and Mechanical Systems Testing & Balancing, Inc.

Chet leads Spectrum’s work on building performance, BEPS compliance, and energy strategy for commercial and multifamily portfolios. His team combines detailed building analytics with practical project experience across Maryland, Washington, DC, and the Mid-Atlantic.